![]()

Simple ways to fight corruption – Young Leaders of the …

How Any Citizen Can Fight And Win Against Political Corruption

How Any Citizen Can Fight And Win Against Political Corruption

Fact Sheet: U.S. Strategy on Countering Corruption | The …

How Any Citizen Can Fight And Win Against Political Corruption

How to stop corruption: 5 key ingredients – News …

Practical Tools to Fight Government Corruption | Edmond J …

How to fight Political Corruption isn’t as difficult as it …

15 ways young people can fight corruption – News …

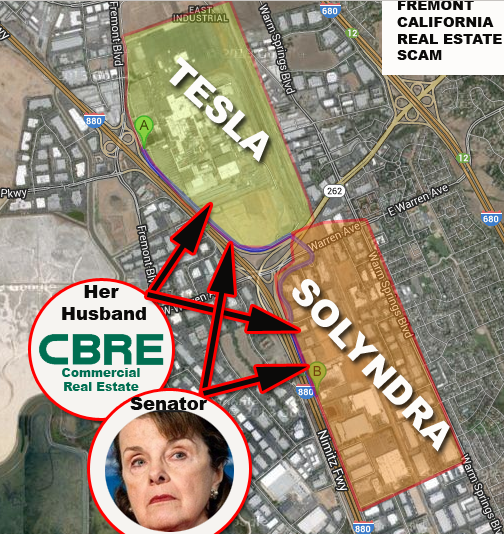

Congress’s Big Tech Stock Stakes Make Regulation Awkward Because Congress Protects Corrupt Silicon Valley

– A proposed antitrust bill has cast a spotlight on the immense portfolios of dozens of lawmakers.

– House Speaker Nancy Pelosi pretty much owns Silicon Valley

At a December press conference, House Speaker Nancy Pelosi was asked her opinion of proposed restrictions on stock trading by members of Congress. Her response was quick and clear: She hated the idea. “We are a free-market economy,” Pelosi, whose family’s shareholdings exceed $100 million, shot back. “They should be able to participate in that.”

Growing numbers of legislators from both sides of the aisle disagree. Following a series of recent abuses, at least five bills making their way through Congress would forbid lawmakers from owning individual stocks or force them to move their assets into a blind trust. One would make violators turn over any profits they earn to the U.S. Treasury Department. Another would extend the ban to family members. A third would also encompass top staffers.

There’s plenty of politicking going on as both sides stake out populist positions ahead of the November elections. A Jan. 19 Morning Consult/Politico poll found that 63% of voters—including majorities from both parties—support a ban on congressional stock trading. “It’s hard to be against it, because it’s easy for people to see the conflict of interest and how it can be abused,” says Jeff Hauser, director of watchdog group Revolving Door Project.

Yet congressional trading persists—and has long failed to attract widespread notice—in part because it’s tough to police. Lawmakers’ financial disclosures are notoriously hard to decipher, sometimes handwritten, and often late or incomplete, and they require members to report only a value range of their holdings rather than a specific dollar figure. And knowing how legislation will affect specific companies can be tricky, making it tough to sort out who stands to gain or lose.

Who Owns What in the House

Data: Insider’s Conflicted Congress Project, Secretary of the Senate, Clerk of the House

*Lawmakers, their spouses, and beneficiaries report according to different disclosure rules and value ranges

That’s what makes a bipartisan antitrust bill moving through the Senate so interesting: It’s a rare case where the stakes of the legislation and the conflicts of interest are unusually clear. The American Innovation and Choice Online Act, introduced by Senators Amy Klobuchar (D-Minn.) and Chuck Grassley (R-Iowa), is aimed at curbing the power of four tech giants: Amazon, Apple, Google’s parent Alphabet, and Meta Platforms (what Facebook now calls itself). It would prohibit those companies from “favoring their own products or services, disadvantaging rivals, or discriminating among businesses that use their platforms in a manner that would materially harm competition.” In other words, the measure seeks to end the gatekeeping practices that smaller companies and antimonopoly activists say the giants of tech use to keep rivals off their turf.

Last summer the House passed a version of the bill. With lawmakers across the political spectrum in favor of reining in Big Tech—albeit for different reasons—the measure has a strong enough chance of passage that Apple Inc. Chief Executive Officer Tim Cook and Alphabet Inc. CEO Sundar Pichai both felt compelled to spend the past few weeks lobbying senators to vote against it.

The fight over the measure highlights the potential conflicts of interest in lawmakers’ shareholdings. A Bloomberg Businessweek examination of financial filings found that at least 18 senators and 77 House members report owning shares of one or more of the companies, and the law could have a significant effect on the value of their portfolios. Pelosi disclosed that her husband has as much as $25.5 million in Apple stock alone. Republican Representative Mike McCaul of Texas reported that his family holds shares of all four tech giants, with a collective value topping $8 million. Last year members of Congress filed more than 4,000 trading disclosures involving more than $315 million of stock and bond transactions, according to Tim Carambat, a researcher who maintains databases of lawmakers’ financial trades.

The tech giants claim the bill would cripple U.S. innovation and lead to all sorts of consumer frustrations. Apple says iPhone owners could be put at risk by unvetted apps downloaded outside its App Store, while Google warns that it may no longer be able to give accurate directions on Google Maps and might have to furnish “low quality” search results. But many smaller tech outfits have argued aggressively on behalf of the proposed limitations, and on Jan. 19 several of them briefed White House officials in support of the bill. “The narrowly tailored legislation would go a long way in preventing the most egregious self-dealing by companies like Google,” Yelp Inc. CEO Jeremy Stoppelman wrote in a blog post.

On Jan. 20 the Senate Judiciary Committee approved the antitrust legislation on a bipartisan 16-6 vote. (Only two committee members, Democrats Jon Ossoff of Georgia and Sheldon Whitehouse of Rhode Island, own shares of the tech giants; both voted to advance the measure.) Amazon.com Inc. slammed it as an “ambiguously worded bill with significant unintended consequences.” Despite the new momentum, its fate remains up in the air. There’s no guarantee Majority Leader Chuck Schumer will bring the bill to the floor, many lawmakers in both parties remain adamantly opposed, and the four companies are aggressively lobbying against it.

Supporters plan to ratchet up the pressure by spotlighting lawmakers’ stakes in the tech titans. “For senators who own stock in the companies that are the targets of this bill, voting against it will absolutely put their motivations into question, as it should,” says Sarah Miller, executive director of the American Economic Liberties Project, which advocates stronger antitrust laws. With growing public anger about congressional trading, that’s a message that could soon come from the left and the right.

On Jan. 19 former President Donald Trump attacked the speaker for her family’s massive shareholdings and the conflict of interest that poses—without mentioning the cronyism that riddled his own presidency, from lobbyists and dignitaries running up big bills at his Washington hotel to charging the government for events at his Florida beach resort. “She should not be allowed to do that with the stocks,” Trump said while promoting a new photo book. “It’s not fair to the rest of this country.” Speaking to reporters a day later, Pelosi reversed herself and signaled that she might be open to a ban on stock trading, after all. “If members want to do that,” she said, “I’m OK with that.”

Do you think these Senators are doing things that are ‘secret’? SOMEBODY knows exactly where they hide their dirty money. A secret program at the Central Intelligence Agency relies on a form of mass surveillance activity that involved the collection of an unknown data set and included the gathering of some records belonging to Americans, according to a newly declassified letter from two Democratic senators.

Details of the CIA program have been kept from the public as well as some lawmakers, according to the April 2021 letter to the agency from Sens. Ron Wyden (D., Ore.) and Martin Heinrich (D., N.M.), members of the Senate Intelligence Committee. The letter was partially declassified and disclosed Thursday.

The nature of the type of collection isn’t made clear in the heavily redacted letter. It couldn’t be determined when the surveillance occurred or if the intelligence program is currently operational. It was also not clear whether another U.S. intelligence agency was performing the actual surveillance that supported the functioning of the CIA program, which isn’t unusual.

The senators’ letter urged the CIA to inform the public about the program, including what kinds of records have been collected, as well as the spy agency’s relationship with its sources of intelligence, the legal framework of the program, the amount of Americans’ records being maintained and how often searches of U.S. data are performed.

“This declassification is urgent,” the senators wrote.

“CIA recognizes and takes very seriously our obligation to respect the privacy and civil liberties of U.S. persons in the conduct of our vital national security mission, and conducts our activities, including collection activities, in compliance with U.S. law, Executive Order 12333, and our Attorney General guidelines,” Kristi Scott, the agency’s privacy and civil liberties officer, said in a statement. “CIA is committed to transparency consistent with our obligation to protect intelligence sources and methods.”

The CIA is generally prohibited by law from engaging in domestic spying. But some U.S. intelligence programs collect broad streams of internet or telephone data in a way that can scoop up information on Americans, such as when someone is communicating with a target of surveillance who lives overseas. Intelligence agencies refer to such information gathered about Americans as incidental collection, an issue that lawmakers in both parties have long said raises privacy concerns because it can evade traditional warrant requirements.

The surveillance activity is authorized under presidential Executive Order 12333, according to the senators’ letter, which is a Reagan-era document that sets rules for some methods of U.S. intelligence gathering. It is not subject to some of the same oversight that governs surveillance activities performed under the Foreign Intelligence Surveillance Act, a decades-old law that created a secretive court to review surveillance requests by U.S. intelligence agencies. But in their letter, the senators say the CIA has run the program “entirely outside the statutory framework that Congress and the public believe govern this collection.”

Ms. Scott didn’t address the senators’ concerns.

A redacted portion of the letter appearing to refer to previous actions by lawmakers said, “history demonstrates Congress’s clear intent, expressed over many years and through multiple pieces of legislation, to limit and, in some cases, prohibit the warrantless collection of Americans’ records, as well as the public’s intense interest in and support for these legislative efforts,” the letter to Director of National Intelligence Avril Haines and CIA Director William Burns said. “And yet, throughout this period, the CIA has secretly conducted its own bulk program.”

Disclosures in 2013 by former intelligence contractor Edward Snowden revealed that the National Security Agency had been secretly operating a program that collected bulk metadata from phone carriers about U.S. phone calls and text messages. The disclosures ignited an international uproar over the scope of America’s electronic-spying capabilities. That program was narrowed by a law passed by Congress in 2015 but has been beset by technical challenges since then and is believed by lawmakers to currently not be operational following the law’s lapse in March of 2020.

Soon after, reporting by The Wall Street Journal and other news organizations disclosed that the CIA was obtaining bulk data from companies such as Western Union Co. on international money transfers that included millions of Americans’ financial and personal data. The program was meant to fill what U.S. officials saw as an important gap in their ability to track terrorist financing world-wide, the Journal reported in 2014.

The letter from the two senators concerns a separate CIA program, according to a report also released Thursday by the Privacy and Civil Liberties Oversight Board, or PCLOB, a government panel that reviews classified intelligence programs. The board’s report refers to the same surveillance activity referenced by the senators as “another classified program” apart from the CIA’s financial data surveillance, which the privacy board also released findings on Thursday.

The privacy board said in its report it researched the CIA’s surveillance program between August 2015 and December 2016. The five-member board’s operations and its ability to release material to the public has been hampered for years by struggles to maintain a quorum.

Senators weren’t aware of the full details of how the CIA program operated before the board completed a review of it in March of 2021, according to the letter by Messrs. Wyden and Heinrich.

“Until the PCLOB report was delivered last month, the nature and extent of the CIA’s collection was withheld even from the Senate Select Committee on Intelligence,” the senators’ letter said.

The CIA, NSA, FINCEN, INTERPOL and many other agencies have ALL of the information to put 90% the California Senators in prison within ANY 48 hour time period. We swear, warrant and certify that this is true.

Why are they not arrested? Because higher up government officials order them to be protected in order to protect their own insider trading!

EVERYBODY likes Scott except… corrupt Silicon Valley bully oligarchs that steal his patented products and the dirty politicians, that Big Tech pays stock market bribes to, that help them do it. Those ‘bad guys’ get taken ‘to the mat’…and the FBI, SEC, FEC, FTC, Interpol, FINCen, Congress and the Federal Courts.

It is no secret that Scott, and his team, take it to the Court when their civil rights are violated and/or they are bias-targeted, or get a vendetta reprisal by public officials who hire Fusion GPS hit-jobbers. Scott’s winning federal cases have been headlines in every major news paper and TV show. The cases have resulted in hundreds of public officials getting indicted, fired and/or arrested for abusing the public and the public policy system. “Winning‘” sometimes means just exposing the corruption.

Big law firms undertake the cases for a percentage of the winnings as their only fee and for the extra promotion that the massive media coverage brings.

The cases serve the public interest. The worst thing any corrupt public official can do is to not give his team the same fair rights as every body else gets. Crony corruption does not sit well with him. His team of investigators (including current, and past, FBI officials) can bring a hellstorm of legal action, a hurricane-size press circus and shame that no public official wants. The biggest fear any corrupt entity has is the nightmare of getting cross-checked on the XKEYSCORE/ICIJ/FINCen/InterPOl financial crimes databases! Such a research query can bring any oligarch to their knees and has resulted in famous tech bosses suddenly leaving their companies. At some point, in many cases, The U.S. Government takes the cause over and sues the bullies like Facebook, Google, YouTube, Instagram and Tesla into legal hell.

The cheapest, safest, most fiscally responsible thing to do with Scott, and his team, is “the right thing”. Entities who chose to “Cheat rather than compete“, always find they have chosen the wrong path.

____________________________

|

|||||||||||||||||||

|