When You Go To Court, Only Go For A Jury Trial!

Why is that? Take a look: CROOKED JUDGES, THE CONFLICTED AND THE BRIBED 1.2

By comparing records and files from FINCEN, FBI, FTC, SEC, Congressional Investigators, ICIJ, FEC, Interpol, CIA, DOJ, ProPublica, and other sources, one can easily see that political officials own Google, Tesla, Facebook, YouTube, Instagram, et al, (AKA “The Tech Cartel” or, in legal terms: “The Enterprise”). This explains why those companies have been exempt from regulation and prosecution. Those public officials and tech company oligarchs have exchanged millions, and millions, of dollars between themselves and their families for profiteering.

They were all either financed by, friends, with, sleeping with, dating the staff of, holding stock market assets in, promised a revolving door job or government service contracts from, partying with, personal friends with, photographed at private events with, exchanging emails with, business associates of or directed by; our business adversaries, or the Senators and politicians that those business adversaries pay campaign finances to, or supply political digital search manipulation services to. Criminal U.S. Senators coordinated and profited in these schemes. Their own family members have now supplied evidence against them. You don’t hear about this, much, in the “main-stream news” because nearly half of Congress, White House staff and government agency bosses own the stock in the news broadcasters and receive billions of dollars of financing from them.

Many witnesses, including us, have now sworn, warranted and certified to federal law enforcement about the details of these crimes. Many of those whistle-blowers were former executives in “The Tech Cartel’.

This is not about politics. It is about felony crimes! Our government representatives are business partners with our biggest enemies and make decisions based on greed, not duty!

Fallout From Judges’ Financial Conflicts Spreads to Appeals Courts

Cases involving StarKist, Bank of America and Cisco are among those reviewed

Federal appeals courts now have to decide whether affected judges’ conflicts were great enough to warrant wiping out their rulings. The Walter E. Hoffman U.S. Courthouse in Norfolk, Va. Photo: Pictometry

By James V. Grimaldi , Joe Palazzolo and Coulter Jones

Fallout from federal judges violating financial-conflict laws is spreading to appeals courts across the nation.

In San Diego, StarKist Tuna is seeking to derail a lawsuit alleging a price-fixing conspiracy costing buyers more than $1 billion. In New York, consumer lawyers want to revive a dismissed case alleging America’s largest banks defrauded investors out of more than $7 billion in bond deals. In Virginia, Cisco Systems is challenging a $1.9 billion patent-infringement judgment.In each case, federal judges had failed to properly recuse themselves after having financial ties to litigants in violation of a 48-year-old law. These violations are having real-world implications for people and companies who resolve disputes in court. The appeals courts now have to decide whether the conflicts were enough to warrant wiping out the rulings by the conflicted judges. Overall, at least 55 cases overseen by judges with recusal violations have been appealed, reconsidered or reassigned to new judges. How newly assigned judges or appellate courts resolve the conflicts could affect public perception of the judicial system, legal experts said. A Wall Street Journal investigation last year revealed that more than 130 judges violated the financial-conflict law

.

Judge Janis Sammartino directed a clerk to file notices of financial conflicts in 140 cases.

Illustration:

Art Lien for The Wall Street Journalthese contested cases, appellate judges will be faced with deciding between fairness and efficiency, legal experts said. Litigants crying foul are asking that judgments be vacated. The other sides argue that the judges’ conflicts amounted to minor errors and that rehearing a case will cost time and money.Vacating a judgment “is inconvenient, it’s inefficient, it’s time-consuming,” said James Sample, a Hofstra University law professor. Yet inconvenience and inefficiency are “problems that the judges themselves have created,” he said. In considering the recusal violations, a 1988 U.S. Supreme Court ruling requires courts to consider the risk of injustice to litigants if they vacate rulings, the risk of injustice in other cases and the risk of undermining the public’s confidence in the judicial process. Litigants in the appeals cases have leaned on the ruling, each side arguing that the test favors their desired outcome. In the tuna fish price-fixing case, StarKist, Bumble Bee and Chicken of the Sea were accused by retail and commercial buyers of conspiring to inflate prices. The cases were filed as StarKist and Bumble Bee pleaded guilty to federal charges of conspiring to fix tuna prices, with fines of $100 million for StarKist and $25 million for Bumble Bee. Judge Janis Sammartino in 2019 had sided with the plaintiffs in certifying a class action, which was overturned by a three-judge panel in April 2021 for abusing her discretion in how she certified the classes.As the Ninth U.S. Circuit Court of Appeal began hearing arguments, the Journal reported that Judge Sammartino’s husband owned shares of companies shares of two members of the plaintiff’s class, Target Corp. ($15,001 to $50,000) and Sysco Corp (less than $15,000). StarKist filed a motion arguing that Judge Sammartino’s recusal violation was yet a further reason to throw out her class certification in the case. “Her family held those interests for years while she was presiding over this case—including some throughout the three-day hearing on class certification—without ever disclosing them to Defendants,” argued lawyers for StarKist

.

StarKist Tuna is seeking to derail a lawsuit alleging a price-fixing conspiracy costing buyers more than $1 billion. Photo: Stephanie Strasburg/Pittsburgh Post-Gazette/Associated Press

Lawyers for the class said StarKist’s objection should be rejected. “StarKist now seeks a ‘do over’ despite years of effort by the parties, the district court, and the Ninth Circuit—supported solely by atmospherics created by the Wall Street [Journal] article and a patently insufficient consideration of the record that is relevant to this case,” the attorneys said in reply. A decision from the appeals court is pending. Judge Sammartino, an appointee of former President George W. Bush, directed a clerk to file notices of financial conflicts in 140 cases after the Journal contacted her. She didn’t respond to a phone message left with her chambers. In another high-stakes appeal in New York, the Journal identified a financial conflict involving federal Judge Lewis Liman, an appointee of President Donald Trump, in a large antitrust class action. The 2020 suit against 10 banks seeks to recover damages that plaintiffs say exceed $10 billion for overcharging them on bond purchases. Judge Liman didn’t disclose that a family member owned as much as $15,000 in Bank of America, a defendant. Last year, Judge Liman granted the motion of defendants including Bank of America to dismiss in the case with prejudice. In a court noticey, the court clerk wrote of Judge Liman that his wife’s “ownership of stock neither affected nor impacted his decisions in this case. However, that stock ownership would have required recusal.” A lawyer for the plaintiffs said they would consider whether to seek relief in the case; they are set to file briefs on the appeal next week. Judge Liman didn’t respond to a request for comment. The bank case is one of 13 lawsuits in which the judge, after an inquiry last month from the Journal, asked a clerk to file notices to parties in those cases saying he should have disqualified himself. Judge Henry Morgan in Norfolk, Va., discovered his own financial conflict in a patent-infringement case that Centripetal Networks Inc., a Virginia company, filed against Cisco Systems. After a bench trial but before issuing an opinion, Judge Morgan disclosed that he had learned that his wife held $4,700 of Cisco stock during the trial.

Judge Henry Morgan was required by law to recuse himself or his wife sell off her Cisco shares for him to continue to hear a case, Cisco Systems argued in legal briefs. Illustration: Art Lien for The Wall Street Journal

Centripetal raised no objection to him remaining on the case, but Cisco requested that Judge Morgan step aside. Though he hadn’t said how he would rule in the case, Judge Morgan had asked the parties for information about damages, a good omen for Centripetal.

At a hearing, the judge said he would direct his lawyer to place the shares in blind trust instead of asking his wife to sell them off. He said he worried that dumping the stock ahead of his opinion on the merits of the case could look bad if he ruled against Cisco.

“I was concerned that, to the extent that the Court’s ruling might have an adverse effect on the stock price—I don’t know if it will or not—that that would be defeating the very purpose of the [ethics] Rules,” Judge Morgan explained in a September 2020 hearing, according to a transcript.He denied Cisco’s recusal motion in October 2020 and soon found that the company infringed Centripetal’s patents, awarding $1.9 billion in damages. Cisco appealed to the U.S. Court of Appeals for the Federal Circuit in Washington, D.C. The company has argued in its briefs that federal law required Judge Morgan to recuse or his wife to sell off her Cisco shares for him to continue to hear the case. Lawyers for Centripetal said in their briefs that Judge Morgan made an ethical decision in moving the Cisco shares into a blind trust. The appellate court has yet to issue a decision. Lawyers for Centripetal and Cisco declined to comment. Judge Morgan, an appointee of former President George H. W. Bush, didn’t respond to a request for comment sent to his chambers.

READ THE PRESS CLIPPINGS ABOUT THE BIG ANTI-CORRUPTION INVESTIGATION:

GOOGLED – The Lies Of The Google Cartel – https://www.thecreepyline.com

THE CORRUPTION CASE – http://www.report-corruption.com

TECH-THEFT – Silicon Valley Oligarchs Rig The USPTO – https://www.usinventor.org

THE INVESTIGATORS – Top Investigators – http://www.ICIJ.org

SECURITY – How To Secure Your Devices From The Thieving Tech Oligarchs – http://privacytools.io

VC’S – The Mobsters Of Silicon Valley Tech – https://vcracket.weebly.com

POLICY NEWS – Balanced News – https://www.allsides.com/unbiased-balanced-news

FORENSICS – Checking The Banking Of The Corrupt Politicians – https://www.openthebooks.com

ATTACKERS – The Hired Hit-Job Assassins – https://gawker-media-attacks.weebly.com/

WALL STREET – The Most Rigged Game In The World https://taibbi.substack.com/p/suck-it-wall-street

BOOKS AND TOP DISCLOSURES – https://congressional-ethics-reports.com/public

ENERGY PAPERS – https://www.the-truth-about-the-dept-of-energy.com/the_energy_scam_papers.pdf

CASE EVIDENCE VIDEOS – https://congressional-ethics-reports.com/NEWS_VIDEO_COVERAGE

TESLA’S LIES – https://gotmusked.com/

- – New Game: Find ONE Senator who isn’t taking bribes, ready, set, GO:

- -“RIGHT TO BUILD” Campaign against ELON MUSK and Tesla Launches!

- -Anatomy of A Civic Corruption Case: San Francisco- The Bridge To Sin

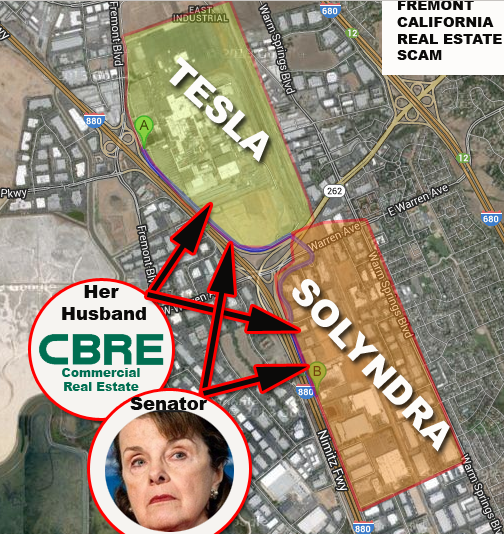

- -Feinstein: Solyndra, Tesla and Greenwald.

- -Over 1000 Reason’s Why Lithium-ion Is a DEADLY, CRIMINAL, VERY BAD THING!

- -Senior Tesla Motors Media Consultant quits. Reveals All! Says “STUPID, STUPID NEWS REPORTERS NOW USING FACTS INSTEAD OF TESLA TALKING POINTS, THUS RUINING THE WHOLE DEAL…”

- -Tesla “Truth Ticket” people are back with Phase 2: PROJECT AXCIOM. Dedicated to making sure every Tesla owner on Earth knows the truth!

- -Tesla Shareholders SUE TESLA. Have FACTS proving EPIC FRAUD and TAXPAYER MONEY SCAM by TESLA!

- -The California “Cargate” Corruption Connection!

- -THE QUESTIONS TESLA MOTORS REFUSES TO ANSWER:

- -What is a Silicon Valley Venture Capitalist, actually?

- “CARGATE”- Here is what investigators now think happened:

- “Elon Musk is a Lying Scumbag” say critics!

- “Help Us Sue Google!” : Company uncovers crimes by Google Bosses

- “Payback is a bitch” Silicon Valley Big Tech –

- (ANTI-CORRUPTION) OUR LATEST PUBLIC-SERVICE LAWSUIT and THE AMERICAN STOCK ACT, To End Senator Stimulus Scam Corruption

- (ARTICLE:) How The “DOMINO HACK” is the biggest hack in history and it has already changed the course of life on Earth!

- (ARTICLE) Google is operating an illegal private corporate international government

- (ARTICLES) “Google Facing Multiple National Investigations”

- (PORTFOLIO) Citizen Crowd-Sourced Federal Lawsuits Against Political Corruption

- (PORTFOLIO) The World Wide Web TV Broadcasting Challenge: WHO DID IT FIRST?

- (PORTFOLIO) The XP Vehicle-Manufacturing Platform We Developed And Patented

- (PORTFOLIO) More Movies About Scott’s Past Work

- (PORTFOLIO) Senior Congressional Advisor

- (PORTFOLIO) That Time Scott Ran For Mayor Of San Francisco

- (REPAIRING SILICON VALLEY) First We Need To Get The Asshole Frat Boys Arrested And Or Fired

- (REPAIRING SILICON VALLEY) Google and Facebook Shouldn’t Lie About How Few Living Beings Use Their Sites

- (REPAIRING SILICON VALLEY) ***** Start With Making Politician Insider Trading ACTUALLY Illegal

- (REPAIRING SILICON VALLEY) ***** Elon Musk Demonstrates How Little He Understands About Reality

- (REPAIRING SILICON VALLEY) ***** Silicon Valley Created A Huge Part Of The Housing Crisis

- (REPAIRING SILICON VALLEY) ***** THE GOOGLE-YOUTUBE-ALPHABET CORRUPTION INVESTIGATIONS

- (REPAIRING SILICON VALLEY) ***** THE LITHIUM LIE – WHEN BATTERIES KILL LITTLE KIDS WHO WORK IN THE BATTERY MINES

- (REPAIRING SILICON VALLEY) ***** The Silicon Valley Invention Rapists

- (REPAIRING SILICON VALLEY) Big Tech’s Financiers Have A Sex Cult Problem

- (REPAIRING SILICON VALLEY) Ending The Bribes Silicon Oligarchs Pay To Your Public Officials

- (REPAIRING SILICON VALLEY) EXPOSED – PROOF THAT FACEBOOK CONTROLS YOUR GOVERNMENT AND RUNS MEDIA COVER-UPS

- (REPAIRING SILICON VALLEY) Google Is Far Worse Than Any Citizen Can Possibly Imagine

- (REPAIRING SILICON VALLEY) How You Can Take Over The Entire Global Internet

- (REPAIRING SILICON VALLEY) If The Feds Won’t Do Their Jobs, Then YOU Can Take Down The Crooks

- (REPAIRING SILICON VALLEY) Silicon Valley’s Crimes Are Enabled By U.S. Government Senior Officials

- (REPAIRING SILICON VALLEY) Some Government Agencies Turn Out To Be Shills Protecting The Crooks

- (REPAIRING SILICON VALLEY) The Crony Electric Car And Energy Scam

- (REPAIRING SILICON VALLEY) The WHITE HOUSE And The PAY-TO-PLAY Bribery Corruption

- (REPAIRING SILICON VALLEY) TOP ARTICLES ON THE ELON MUSK INVESTIGATION

- (REPAIRING SILICON VALLEY) Why Don’t They Arrest The Oligarchs That Organize Voting Fraud Programs?

- (REPAIRING SILICON VALLEY) Why Silicon Valley Is Utterly Incapable Of Keeping Your Data Safe

- (WORLD NEWS) ***** Watch Out For Judges That Took Stock Bribes

- (WORLD NEWS) The Panama Papers And The ‘Green’ Car Cartel (VIDEO)

- (WORLD NEWS) Why Do My Senators Get To Own My Competitors And Use Government Money To Attack Me In Order To Protect Those Competitors?

- (WORLD NEWS) Join The Party: The Anti-Corruption Party

- (WORLD NEWS) Meet ‘THE CARTEL’ Tech Mobsters Of Silicon Valley

- (WORLD NEWS) Silicon Valley Tech Oligarchs Steal Most Of Their Technology From Small Inventors

- (WORLD NEWS) The Dirty Politicians Have Already Been Caught, They Just Don’t Know It Yet!

- (WORLD NEWS) THE ELON MUSK CORRUPTION INVESTIGATIONS – PART TWO

- (WORLD NEWS) YOU, As An Individual, Can Fight Corruption And Win!

- (WORLD NEWS) ***** THE FACEBOOK AND META CORRUPTION INVESTIGATIONS

- (WORLD NEWS) ***** The DURHAM Investigations Tie Back To A Trillion Dollar+ ‘GREEN ENERGY’ Mining Corruption Scam

- (WORLD NEWS) ***** Woke Idiotic Netflix is Going Broke So It Lies About Why Nobody Watches It

- (WORLD NEWS) How Elon Musk Buys Fake Hype To Promote Himself And Rig The Stock Market

- (WORLD NEWS) MUSK, THE MASTER OF COVER-UPS, PRETENDS TO SUPPORT ‘FREE SPEECH’

- A Case Example of The Corruption That Let’s American’s Down:

- A Dear John Letter – Silicon Valley Version:

- ABOUT THE CLEANTECH CRASH CASE

- ACTUAL CRIMES! And the indictments go to…..

- Additional Tesla Articles- Section 1A

- AMERICAN CORRUPTION –

- An Open Letter To John Doerr of Kleiner Perkins, Dark Lord Of Silicon Valley’s Corruption

- An Open Letter To Peter Thiel

- AN OPEN LETTER TO TESLA MOTORS: (Public Response Required!)

- AN OPEN LETTER TO THE U.S. DEPARTMENT OF ENERGY

- Analyzing How Google Rigged Internet Searches For Elon Musk and his companies from 2007 to today

- ANATOMY OF A SILICON VALLEY CARTEL “BURN NOTICE”: TECH BILLIONAIRES COPY SPY HIT-JOB TACTICS TO WIPE OUT ADVERSARIES

- ANTI GOOGLE BUS DEMANDS OF THE PUBLIC SET FOR THE NEXT PROTEST

- Anti-Corruption School

- Anti-Trust Charges Filed Against the National Venture Capital Association “Crime Club”

- Ashley Madison Sex Web Site totally hacked. All Major Dating Websites Now Hacked. User Data For Sale By Hackers. How To Stay Protected Online!

- BRIBES!!! Google Accused Of Using US Congressmen To Lobby Against EU Antitrust Case

- BRIDGE CASE #1: GOLDEN GATE BRIDGE

- California political leaders are only as “green” as their bank accounts

- California’s Operation Of The Silicon Valley Corruption and Bribery Cleantech Crash Scam Earns Guv A New Beat Down –

- Calling all citizens to help shut-down the criminal operations of Google, Facebook and The Silicon Valley privacy rapists

- CARGATE CARTOON- Easy, Fun, News!

- CARGATE: The California Connection

- CARGATE: THE CARTOON! The World’s first interactive WiKi/public produced social cartoon!!!!!!!!!!

- CHARGES AGAINST GOOGLE/ALPHABET

- CLASS-ACTION LAWSUIT TO SUE GOOGLE FOR $200B ON BEHALF OF U.S. CITIZENS

- CNBC’s “Squawk Box”says Elon Musk and Tesla Motors a ‘fraud’.

- Collapse of Corrupt San Francisco Skyscraper Estimated to kill twice as many as 9/11

- Column: THE TAKEDOWN – Perp walking the big dogs

- CONGRESS ASKED TO HAVE SPECIAL PROSECUTOR EXAMINE CROOKED TESLA MOTORS –

- Consumer Safety Cover-up- The Tesla Motors Scandal

- Corruption Mapping –

- Could Google Really Be Involved in Global Political Conspiracies? Look What Was Just Uncovered:

- COVER-UP!!!!!!!!!!!!!!!!!!!!!!!!!!!

- Creator of Lithium Ion Batteries Confesses To Their Dangers –

- Criminal corporate & political sex workers and party services LESSON 1 (NSFW)

- Deadly Tesla Fires, Crashes, Corruptions and Cover-up Charges Are Too Much For White House –

- Department of Energy attempts cover-up and whitewash of the most criminally corrupt program in U.S. history!

- Department of Energy attempts cover-up and whitewash of the most criminally corrupt program in U.S. history!

- Dept Of Energy Corruption Victim: XP VEHICLES

- Did Senator Harry Reid take bribes from Elon Musk (MEME)

- DNC Leaks Prove That Google Bosses Put “Hit-Jobs” on Political Targets For DNC!

- Do Tesla Motors Cars Cause Anal Sores?

- Does A Mafia-Like Organization Run The Venture Capital Business?

- DRIVING A TESLA IS “CRIMINAL” SAYS REPORT- FBI ASKED TO INVESTIGATE TESLA

- DRIVING A TESLA IS NOT “COOL”!- IT IS CRIMINAL!

- ELON MUSK

- ELON MUSK – An Inside Look –

- Elon Musk and Tesla Are Suddenly Confronted With More Scandals and Failures

- Elon Musk and The White House: Corruption was never so Black and White

- Elon Musk goes “full asshole” and personally cancels blogger’s Tesla order after ‘rude’ post

- Elon Musk is the MASTER of FAKE NEWS! Musk has spent a billion dollars self promoting hype about himself

- Elon Musk’s Lithium Ion Batteries Are Setting The World On Fire as Hoverboards and Tesla’s Explode In Flames World Wide

- Elon Musk’s SpaceX Is An Ego-maniacal Trip Into Bad Engineering –

- Elon Musk’s Powerwall Would Take Almost 40 Years To Pay For Itself

- ERIC HOLDER’S LASTING LEGACY: The Corruption of the U.S. Justice System

- Eric Schmidt is spending billions of dollars to fake up a “Patent Troll” issue which does not actually exist!

- Evil Corporations and Corrupt Billionaires, Beware!

- FBI AND FTC ASKED TO INVESTIGATE SILICON VALLEY MAFIA

- FEATURES: HOT TOPICS

- Feinstein: Solyndra, Tesla and Greenwald.

- File Your RICO Case: Get Your Cash!

- For 4th of July: Elon Musk to explode more Tesla’s and Space X rockets!

- FRAUD CHARGES AGAINST ELON MUSK PROVE MUSK AND GOOGLE IN BED TO RIG INTERNET SEARCH RESULTS

- FRAUD CHARGES AGAINST ELON MUSK PROVE MUSK AND GOOGLE IN BED TO RIG INTERNET SEARCH RESULTS

- GAWKER BANKRUPTCY CASE DELIVERS EVEN BIGGER SCANDALS IN THE GAWKER LEGAL HELL-SCAPE

- Gawker Media Drags Univision and Unimoda Into The Mud! UNIMODA investors could rescind Gawker Purchase!

- Global Boycott of Tesla Motors Called For. “Tesla’s Price of Corruption and Lies Should Be The End Of Tesla!”

- GOOGLE ABUSES PEOPLE, ROBOTS AND SOCIETY –

- Google Bribes Politicians

- GOOGLE CAUGHT PAYING BRIBES IN USA AND EUROPE

- Google is operating an illegal private corporate international government

- GOOGLE SHOULD BE “TERMINATED” –

- Google Sued For Rigging The Internet and Running Dirty Tricks Campaign

- Google Under Fire From Most Consumers –

- Google’s Corruption And Alphabet’s Abuse Of Society

- Google’s Horrific Abuses Of Society

- Google’s Management of the The Silicon Valley Cartel

- Google’s purpose in life: POLITICAL MANIPULATION!

- GOOGLE’S SEARCH ENGINE RIGGING ATTACKS

- Here is what happens to you when you cross paths with a Silicon Valley Mobster

- Hometown Public Journalism Wiki’s: SF Bay Area – Senator Yee arrested for organized crime

- How A Tech Mobster Racketeering Case Lays Out

- HOW CORRUPT IS TESLA MOTORS?

- How Did Elon Musk get involved in so many dirty schemes?

- How Elon Musk and Dianne Feinstein Became Partners In Crime: LITERALLY!

- How Elon Musk paid millions in order to fake a fan club on Twitter

- How Elon Musk Politically Raped His Way To The Top

- How government grant and loan “contests” can actually be rigged kick-back schemes: LESSON 1

- How The New Mafia Took Over Washington DC: The Tech Mobsters

- How The White House Ordered “Hit Jobs” on Families Across America

- HOW TO BE A SENATOR

- HOW TO CRASH GOOGLE & DELETE IT FROM THE WORLD!

- HOW TO CRASH GOOGLE AND DELETE THE NAZI’S OF GOOGLE FROM THE WORLD –

- How To Investigate, and Legally Terminate, any Corrupt Official

- How White House Staff Put Hit-Jobs on Domestic American Business Competitors on Orders from Silicon Valley Campaign Financiers

- HSBC Organized Crime Reports and Leaks Reveal Silicon Valley Bribes of U.S. Officials

- In the next Presidential Debates, Each Candidate Must Identify Which Lobbyist Paid for Which Thing They are About To Say!

- INVESTIGATING TESLA MOTORS – PART B

- INVESTIGATION-22 Part 10. Big Revelations In The News – Section B

- INVESTIGATION-22 Part 17. Killing The Whistle-Blowers & Reporters

- INVESTIGATION-22 Part 20. How The Age of Transparency Blew the Scheme Up

- INVESTIGATION-22 Part 22. The Tesla Motors Corruption. Section B

- INVESTIGATION-22 Part 23. The Tesla Motors Corruption. Section C

- INVESTIGATION-22 Part 8. The Cover-Up

- Is Elon Musk A Fraud?

- Is Fred Lambert a “Lying Sack of Shit”? Is Fred Lambert Covering Up Elon Musk’s Felony-Class Crimes?

- Join The Party: The Anti-Corruption Party

- Larry Page’s Ugly Flying Car Spotted In The Wild

- Leaks Reveal Elon Musk Is A Fraud Who Is Protected By Obama in Exchange For Funding DNC Campaigns

- Let’s take a look at Musk’s criminality

- Lithium ion danger warning site raises huge red flags! Warnings ignored?

- Lobbying With Bribes

- Maybe You Heard: The System Is Rigged

- McKinsey Consulting

- Meet The Characters of The Cleantech Crime Scam:

- More Hacked Documents Released: SHOCKERS!!! CLEANTECH HACK HIGHLIGHTS

- MOTLEY FOOL REVEALS ITSELF TO BE AN ILLEGAL SHAM FRONT FOR TESLA MOTORS AND ELON MUSKS INVESTORS

- New Book About Tesla Motors Offers Shocking Inside Views Of Car Company

- New Leak In Gawker Media Bankruptcy Case Reveals What Gawker’s True Purpose Was

- OBAMA Vehicle Safety Agency Covers Up Tesla Fire and Anal Sores Dangers To Protect Obama in Crony Payola Scam

- ON-TOPIC EXPOSE DOCUMENTARIES and DOCUDRAMAS

- ORGANIZED CRIME IN SILICON VALEY: THE TAKE DOWN

- Overwhelming Majority of Americans Believe Both Parties Are Too Corrupt to Change Anything

- Panasonic and Tesla: Two of the world’s most epically criminal companies have joined forces

- Petition For Court Order Against Ropes and Gray/Gawker Media

- POLITICAL PAYBACK TACTICS USED

- PRESS RELEASE: TESLA MOTORS NEW ANNOUNCEMENT

- Prostitutes!!! Lot’s of them! Sex and The Politicians

- READ THE BOOK:

- REPORT CORRUPTION

- Report Corruption and Crime To Our Peers And Associates

- Russia Insider – Google Bribes Politicians

- San Francisco Residents Seem To Hate Google

- Scientists Discover That Lithium Ion Batteries Grow More Explosive Over Time

- SECRET POLITICIAN SCAM DEALS, PART 1

- Silicon Valley

- Silicon Valley Has Killed Itself- Nobody trusts Apps, Phones or Social Media Ever Again!

- Silicon Valley Men Advise Each Other On How To Rape and Sex Traffic and Not-get-caught

- Silicon Valley Tech Oligarchs Steal Most Of Their Technology From Small Inventors

- SILICON VALLEY TECH TITANS HAVE A PLAN TO MAKE SURE TRUMP CANNOT ACCOMPLISH ANYTHING: THE SILICON BLOCKADE

- Social Media Corruption –

- SOLYNDRA WAS JUST THE TIP OF THE ICEBERG

- Stock Market Corruption –

- TECH EYE – Google Offers Bribes To Journalists

- Terrified Elon Musk tries to save his “scam” railroad project by saying it is now an OUTER SPACE TRAIN

- TESLA “SUDDEN ACCELERATION” COVER-UP CHARGED!

- Tesla and Google Partnered on the Same Scam Against The Public

- Tesla Had 5 Founders. Only Two Got Really Rich Because They Were Part Of Elon Musk’s Racketeering Schemes

- TESLA investors sue Tesla claiming Tesla is EPIC FRAUD SCAM

- TESLA MOTORS TAKES BILLIONS IN TAXPAYER PAYOLA YET HIRES OVERSEAS LABOR TO PUT AMERICANS OUT OF WORK

- TESLA MOTORS: CREATED BY CORRUPTION!

- TESLA MOTORS: DEATHS, MORE FIRES AND COVER-UPS

- TESLA SAFETY REPORT Vers. 1.05M- Public Wiki Produced for NHTSA and other governmental agencies

- TESLA SAFETY REPORT- v. First Draft Public Wiki Produced for NHTSA and other governmental agencies

- Tesla Standard Pitch To Each Country

- Tesla TOXIC SMOKE! THE FACTS ON TESLA FIRES:

- Tesla Under Fire After Explosive Crash: Tesla Death Cars Charged With Safety Cover-ups –

- Tesla’s Bribery of California Officials Gets Uber Mad Because Uber’s Bribes Were Not As Big As Elon Musk’s

- Tesla’s Cover-Up Is Falling Apart- Lawsuits Filed- NHTSA Charged With Hiding Tesla Dangers To Protect Obama

- Test, using billions of people, proves that TESLA CARS destroy the environment

- Text of the Speech About Corruption Presented To The California State Capitol

- THE AFGHAN CASE, #111

- The Afghan Papers – Part 15

- THE ATTACKS

- The Cleantech Crash Is Back To Haunt The Department Of Energy

- THE CLEANTECH MURDERS

- THE CORRUPTION OF SENATOR FEINSTEIN

- The Corruption Of The Feinstein’s

- THE CRIMES

- The Current Take-Down List Of Criminal Suspects in the Silicon Valley Coup D’Etat Attempt

- THE DEADLIEST BATTERY ON EARTH!

- The Dianne Feinstein Investigation

- The Facebook Meta Corruption And Corporate Lies –

- The Ghost Of Solyndra: A Trillion Dollars Of Your Tax Money Is Missing

- THE GOOGLE INVESTIGATION

- The Google Murders!???

- The Hit Jobs: The True Story Behind the U.S. Department of Energy Scandal

- The Horror and Tragedy of Tesla Motors Anal Sores

- THE HUNTING GROUND exposes how Silicon Valley Elite families order colleges to cover-up Frat House rapes.

- THE INSIDE TESLA INVESTIGATION

- The noose tightens: Senator Calderon Busted by FBI; Bigger Senators in FBI sights…

- THE ORGANIZED CRIME IN PUBLIC OFFICE INVESTIGATION

- The Panama Papers And The ‘Green’ Car Cartel (VIDEO)

- The Panama Papers And The Green Car Scam (VIDEO)

- The Pedophile’s of British Elite Circles. Which other famous British and American Elites are involved?

- The Plan to Put Elon Musk Out Of Business As Punishment For His Capitol Crimes

- THE PRIVACY RIGHTS INVESTIGATION

- The Securities and Exchange Commission (SEC) has now become America’s biggest running joke. Hires it’s arch enemy to run the place.

- The Silicon Valley Cartel: The Biggest Scam In Tech

- The Silicon Valley Tech Mafia Are Trying To Start A Civil War –

- THE U.S. DEPARTMENT OF ENERGY IS OPERATED AS AN ORGANIZED CRIME CARTEL SCAM

- THIS IS YOUR TESLA MOTORS INTERVENTION:

- Top Video Documentaries And Video News Reports

- TSLA Tesla Stock. “Shill”, Fake, “Pump” and manipulate tech stocks with tax $$$!

- U.S. Department of Energy Faces Hell Storm Of Charges

- U.S. Senator charged with running multi-billion dollar taxpayer scam using stock warrants as bribes

- Uber Charges California Politicians With Taking Massive Bribes from Tesla and Elon Musk

- UNION HATING ELON MUSK FINDS THAT HIS CORRUPTION IS COMING BACK TO BITE HIM ON EVERY FRONT –

- UNIVISION FORCED TO LAY OFF HUNDREDS OF EMPLOYEES. IS UNIVISION ABOUT TO GO “SOLYNDRA”!

- What are the things the media has said that Tesla did?

- What Does The “Silicon Valley Cartel” Do To You If They Feel Offended?

- What is “CORRUPTION”? –

- What is the proof that the attacks on the Cleantech Crash citizen-victims were a state-sponsored vendetta program?

- WHEN GRANTS ARE KICKBACKS CASE #2

- WHO ARE THE KNOWN BAD GUYS IN THIS CASE?

- Who Bribes Politicians and Rigs Elections At Google? –

- WHO BRIBES THE PRESIDENT AND SENATE?

- Who Is Hacking And Crashing All Of The Tesla’s?

- WHY ELON MUSK AND JOHN DOERR TRY TO SABOTAGE HYDROGEN AND FUEL CELLS

- Why Google Must Be Eradicated From The Earth

- Why Silicon Valley Tech Oligarchs Are The Most Horrible People On Earth

- WIKILEAKS AND HSBC LEAKS SEAL GOOGLE’S FATE. CORRUPTION REVEALED. LAWSUITS TO BE FILED.

- WILSON SONSINI GOODRICH AND ROSATTI: THE LAWYERS FOR MORALLY CHALLENGED CLIENTS

- XP VEHICLES: Federal Agency Corruption Hits Home