WILSON SONSINI GOODRICH AND ROSATTI: THE LAWYERS FOR MORALLY CHALLENGED CLIENTS

Submission By Oscar Reu For Law 360

Many articles refer to the law firm of WILSON SONSINI GOODRICH AND ROSATTI as “WSGR”. Other articles refer to them as “The law firm of crooks and mobsters” and “The HSBC of the legal profession”.

Why?

Let us examine the variety of ethics charges and questionable dealings of WSGR as they are posted on public sites:

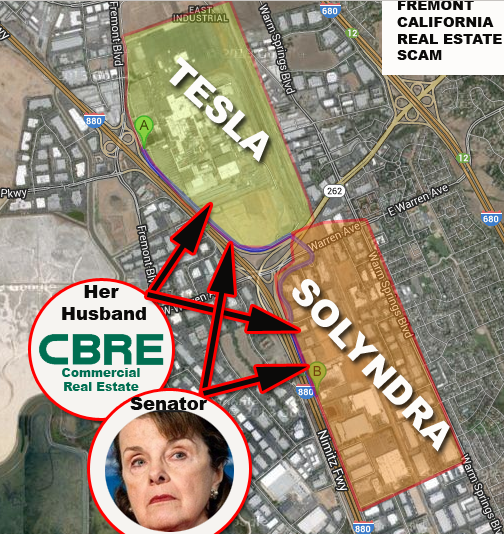

WSGR AND THE TESLA CORRUPTION INVESTIGATION

Tesla is also facing a U.S. Securities and Exchange Commission inquiry into financial disclosures related to the fatal crash, according to The Wall Street Journal. The company did not disclose the autopilot feature’s role in the fatal crash in securities filings related to a $2 billion stock sale in mid-May. (Securities filings show that Wilson Sonsini Goodrich & Rosati advised on that stock sale.)

Why would WSGR advise Tesla to hide SEC reporting of the deaths, explosions, executive walk-offs, frauds and other critical public disclosures?

EX-5.1

Exhibit 5.1

|

|

|

650 Page Mill Road Palo Alto, CA 94304-1050 PHONE 650.493.9300 FAX 650.493.6811 www.wsgr.com |

May 25, 2016

Tesla Motors, Inc.

3500 Deer Creek Road,

Palo Alto, California 94304

|

|

Re: |

Registration Statement on Form S-3 |

Ladies and Gentlemen:

We have acted as counsel to Tesla Motors, Inc., a Delaware corporation (the “Company”), in connection with the filing by the Company with the Securities and Exchange Commission (the “Commission”) on May 18, 2016 of a registration statement on Form S-3 (the “Registration Statement”), under the Securities Act of 1933, as amended (the “Act”), that is automatically effective under the Act pursuant to Rule 462(e) promulgated thereunder. The Registration Statement relates to, among other things, the proposed issuance and sale, from time to time, by the Company of debt securities (the “Debt Securities”) and shares of the Company’s common stock (the “Common Stock”), $0.001 par value per share (the “Company Common Stock”), each with an indeterminate amount as may at various times be issued at indeterminate prices, in reliance on Rule 456(b) and Rule 457(r) under the Act. The Debt Securities and the Common Stock are to be sold from time to time as set forth in the Registration Statement, the prospectus contained therein, and the supplements to the prospectus. The Registration Statement also relates to the proposed sale by the selling stockholders to be identified in the applicable prospectus supplement, from time to time, pursuant to Rule 415 under the Act, as set forth in the Registration Statement, the prospectus contained therein and the supplements to the prospectus, of shares of Common Stock (the “Selling Stockholder Common Stock” and together with the Debt Securities and the Company Common Stock, the “Securities”).

Pursuant to the Registration Statement, the Company has issued and sold 7,915,004 shares of Common Stock (the “Company Shares”), and Elon Musk (the “Selling Stockholder”) has sold 2,782,670 shares of Common Stock (the “Selling Stockholder Shares” and, together with the Company Shares, the “Shares”), all of which will be sold pursuant to that certain Underwriting Agreement, dated as of May 19, 2016 (the “Underwriting Agreement”), by and among the Company, the Selling Stockholder and Morgan Stanley & Co. LLC and Goldman, Sachs & Co., as representatives of the several underwriters named in Schedule I thereto.

We have examined the Registration Statement, together with the exhibits thereto and the documents incorporated by reference therein; the prospectus, dated May 18, 2016, together with the documents incorporated by reference therein, filed with the Registration Statement (the “Prospectus”); the preliminary prospectus supplement, dated May 18, 2016, in the form filed with the Commission pursuant to Rule 424(b) of the Securities Act relating to the offering of the Shares; and the final prospectus supplement, dated May 19, 2016, in the form filed with the Commission pursuant to Rule 424(b) of the

AUSTIN BEIJING BRUSSELS HONG KONG LOS ANGELES NEW YORK PALO ALTO SAN DIEGO

SAN FRANCISCO SEATTLE SHANGHAI WASHINGTON, DC WILMINGTON, DE

Tesla Motors, Inc.

May 25, 2016

Page 2 of 3

Securities Act relating to the offering of the Shares (together with the Prospectus, the “Prospectus Supplement”). In addition, we have examined originals or copies, certified or otherwise identified to our satisfaction, of such other instruments, documents, certificates and records which we have deemed relevant and necessary for the basis of our opinion hereinafter expressed. In such examination, we have assumed: (i) the authenticity of original documents and the genuineness of all signatures; (ii) the conformity to the originals of all documents submitted to us as copies; (iii) the truth, accuracy and completeness of the information, representations and warranties contained in the instruments, documents, certificates and records we have reviewed; (iv) the Underwriting Agreement has been duly authorized and validly executed and delivered by the parties thereto (other than the Company and the Selling Stockholder); (v) that the shares of Common Stock will be issued and sold in compliance with applicable U.S. federal and state securities laws and in the manner stated in the Registration Statement and the Prospectus Supplement; and (vi) the legal capacity of all natural persons. As to any facts material to the opinions expressed herein that were not independently established or verified, we have relied upon oral or written statements and representations of officers and other representatives of the Company and of the Selling Stockholder.

We express no opinion herein as to the laws of any state or jurisdiction, other than the Federal laws of the United States of America and the General Corporation Law of the State of Delaware (the “DGCL”), as such are in effect on the date hereof, and we have made no inquiry into, and we express no opinion as to, the statutes, regulations, treaties, common laws or other laws of any other nation, state or jurisdiction.

We express no opinion as to (i) the effect of any bankruptcy, insolvency, reorganization, arrangement, fraudulent conveyance, moratorium or other similar laws relating to or affecting the rights of creditors generally, (ii) rights to indemnification and contribution which may be limited by applicable law or equitable principles, or (iii) the effect of general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, the effect of judicial discretion and the possible unavailability of specific performance, injunctive relief or other equitable relief, and the limitations on rights of acceleration, whether considered in a proceeding in equity or at law.

Based on the foregoing, we are of the opinion that:

|

|

1. |

The Company Shares, when issued, delivered and paid for in accordance with the terms of the Underwriting Agreement, will be validly issued, fully paid and nonassessable. |

|

|

2. |

The Selling Stockholder Shares have been duly authorized and are validly issued, fully paid and nonassessable. |

We hereby consent to the filing of this opinion as an exhibit to the above-referenced Registration Statement and to the use of our name wherever it appears in the Registration Statement, the Prospectus, each Prospectus Supplement, and in any amendment or supplement thereto. In giving such consent, we do not believe that we are “experts” within the meaning of such term as used in the Act or the rules and regulations of the Commission issued thereunder with respect to any part of the Registration Statement, including this opinion as an exhibit or otherwise.

Tesla Motors, Inc.

May 25, 2016

Page 3 of 3

|

Very truly yours, |

|

WILSON SONSINI GOODRICH & ROSATI |

|

Professional Corporation |

|

/s/ Wilson Sonsini Goodrich & Rosati |

New car pickup at Tesla’s Fremont, CA factory. December 8, 2012. Credit: Steve Jurvetson. (Per Wikimedia Commons).

Legal trouble is brewing for Tesla Motors Inc.

The family of a man who died in a crash while his Tesla Model S was driving itself has hired a personal injury attorney, and regulators are reportedly looking into the company’s financial disclosures related to the accident.

The family of Joshua Brown, a 40-year-old who died in the May 7 crash in Williston, Florida, hired Cleveland personal injury attorney Jack Landskroner. His firm, Landskroner Grieco Merriman, confirmed its representation of the Brown family to The Am Law Daily on Tuesday.

Fortune reported Monday that the firm is currently investigating the crash and has not ruled out suing the upstart Palo Alto, California-based car company founded by patent-averse billionaire Elon Musk. Brown was a resident of Canton, Ohio, and a high-ranking member of the U.S. Navy.

Tesla is also facing a U.S. Securities and Exchange Commission inquiry into financial disclosures related to the fatal crash, according to The Wall Street Journal. The company did not disclose the autopilot feature’s role in the fatal crash in securities filings related to a $2 billion stock sale in mid-May. (Securities filings show that Wilson Sonsini Goodrich & Rosati advised on that stock sale.)

A Tesla spokeswoman declined to respond to questions for this story, including whether it had hired outside counsel for potential legal matters stemming from the fatal crash. Irell & Manella, which has represented Tesla in past securities litigation, did not return a request for comment.

In blog posts responding to the crash, Tesla said the May fatality was the first of its kind under its autopilot feature. The feature had been used in more than 130 million miles of driving, which the company said proves it has a “better-than-human” driving capability. U.S. drivers average a fatality every 94 million miles, the company said.

“News of a statistical inevitability did not materially change any statements previously made about the Autopilot system, its capabilities, or net impact on roadway safety,” according to Tesla.

The company said it was not immediately aware that the autopilot feature was engaged during Brown’s crash, which it reported to highway safety authorities on May 16. On May 18, Tesla filed a financial prospectus with the SEC as it prepared to sell about $2 billion in stock. That filing did not disclose that Brown’s autopilot was engaged during his crash. Tesla said it obtained data for the first time from Brown’s car on the same day.

In past securities litigation in California resulting from a stock drop after battery fires in its cars, Tesla turned to Irell & Manella partner David Siegel, according to a report by sibling publication The Recorder. The firm’s legal team was successful in getting that suit dismissed, but a federal judge in San Francisco declined a request for fees from plaintiffs’ attorneys.

Irell & Manella did not return a request for comment about its work for Tesla. The company’s general counsel, Todd Maron, was once an associate at the firm.

Tesla has reshuffled its in-house legal ranks in recent months, as former deputy general counsel and vice president of regulatory affairs James Chen left in January and subsequently joined auto startup rival Faraday Future as its new top in-house lawyer, according to sibling publication Corporate Counsel.

January also saw Tesla hire Baker, Donelson, Bearman, Caldwell & Berkowitz partner Wendy Padilla-Madden as senior corporate counsel for global immigration in Fremont, California. Tesla, which late last year recalled 90,000 Model S cars due to a seat belt problem, also hired Skadden, Arps, Slate, Meagher & Flom earlier this year to handle a suit against a Swiss auto parts supplier over a faulty door prototype.

WSGR AND THE SOLYNDRA CORRUPTION

Wilson Sonsini Defends Itself Against Solyndra Accusations

amlawdaily.typepad.com/amlawdaily/2011/…/wilson–sonsini–solyndra.ht…

Oct 11, 2011 – Wilson Sonsini was drawn deeper into the Solyndra fray over the weekend when The New York Times reported that Steven Spinner—a senior …

Wilson Sonsini denies conflict due to Solyndra work – San Francisco …

www.bizjournals.com/…/wilson–sonsini–so…

South Florida Business Journal

Oct 12, 2011 – Wilson Sonsini Goodrich & Rosati P.C. is refuting suggestions that its work for bankrupt solar panel maker Solyndra created a conflict of interest …

Wilson Sonsini Cites ‘Ethical Wall’ in Defending Its Solyndra Work

www.abajournal.com › Daily News

ABA Journal

Oct 12, 2011 – Wilson Sonsini Goodrich & Rosati says it built an “ethical wall” around a lawyer married to an energy department official who pushed for a loan …

Wilson Sonsini Defends Itself Against Solyndra Accusations | The …

www.americanlawyer.com/…/Wilson–Sonsini-Defend…

The American Lawyer

Wilson Sonsini Defends Itself Against Solyndra Accusations. Brian Baxter, The American Lawyer. October 11, 2011 | 0 Comments. share. share on linkedin …

Wilson Sonsini Defends Itself Against Solyndra Accusations | The …

www.americanlawyer.com/…/Wilson–Sonsini-Defe…

The American Lawyer

Oct 11, 2011 – For the text of this article, see “Wilson Sonsini Defends Itself Against Solyndra Accusations,” from The Am Law Daily.

Official Questioned Legality of Altering Solyndra Loan – WSJ

www.wsj.com/…/SB100014240529702042945045…

The Wall Street Journal

Oct 8, 2011 – Mr. Spinner’s wife is a partner at Wilson Sonsini Goodrich & Rosati, a law firm based in California that represented Solyndra as part of the …

Obama Fundraiser Pushed Solyndra Deal From Inside – ABC News

abcnews.go.com/Blotter/obama-fundraiser-pushed-solyndra…/story?id…

Oct 7, 2011 – Recovery Act records show Allison Spinner’s law firm, Wilson Sonsini, received $2.4 million in federal funds for legal fees related to the $535 …

Government adviser defends Solyndra despite ethics agreement – The …

https://www.washingtonpost.com/…solyndra…/gIQ…

The Washington Post

Oct 9, 2011 – Government adviser defends Solyndra despite ethics agreement … worked for Wilson Sonsini, a California law firm that represented Solyndra, …

Lawmakers Ask MoFo, Wilson Sonsini For Solyndra Docs – Law360

www.law360.com/…/lawmakers-ask-mofo-wilson–sonsini-for-sol…

Law360

Jan 13, 2012 – House Republicans on Thursday targeted Morrison & Foerster LLP and Wilson Sonsini Goodrich & Rosati PC over the Solyndra LLC …

THIS IS AN OUTRAGE! Taxpayers paid the law firm Wilson Sonsini 2.4 …

gretawire.foxnewsinsider.com/…/this-is-an-outrage-taxpayers-paid-the-law-firm-wilson–s…

Oct 12, 2011 – Since (according to the LA Times) we paid Solyndra’s legal bill to Wilson Sonsini of $2.4 million, I would like to know what was done…wouldn’t …

Disputing the participation of law firm Wilson, Sonsini, Goodrich and …

https://tolkeintales.wordpress.com/…/disputing-the-participation-of-law-firm-wilson–s…

Jun 23, 2016 – Plaintiffs are informed that WSGR helped TESLA engage in organized crime …. Wilson Sonsini Defends Itself Against Solyndra Accusations.

Obama fundraiser backed Solyndra – POLITICO

www.politico.com/story/2011/10/obama-fundraiser-backed-solyndra-065448

Politico

Oct 7, 2011 – In a Sept. 23, 2009, email to DOE ethics official Sue Wadel, Spinner disclosed the companies, including Solyndra. But he wrote that “WSGR has …

Obama fundraiser took active interest in Solyndra loan, emails show …

articles.latimes.com/2011/oct/08/business/la-fi-solyndra-white-house-20111008

Oct 8, 2011 – Obama fundraiser took active interest in Solyndra loan, emails show … Federal records show that Allison Spinner’s firm, Wilson Sonsini …

The Solyndra Steves – | National Review

www.nationalreview.com/article/283191/solyndra-steves-andrew-stiles

National Review

Nov 15, 2011 – The Solyndra loan scandal is a case study in crony capitalism run amok. … was a partner at Wilson Sonsini, the law firm representing Solyndra …

More Solyndra Stink | Liberty Unbound

www.libertyunbound.com/node/756

Feb 25, 2012 – The stench of corruption that characterizes the Solyndra scandal — the … He was also CEO of Wilson Sonsini when its clients received all that …

TOP OBAMA FUNDRAISER OK’ED SOLYNDRA LOAN – DickMorris.com

www.dickmorris.com/top-obama-fundraiser-oked-solyndra-loan/

Oct 2, 2011 – Spinner’s wife, Allison’s law firm Wilson, Sonsini, Goodrich & Rosati got $2.4 million in legal fees to handle the legal work in connection with the …

ICYMI Venture Capitalists Play Key Role In Obama’s Energy Department

https://www.gop.com/icymi-venture-capitalists-play-key-role-in-oba…

Republican Party

Feb 15, 2012 – Wilson Sonsini’s clean-tech clients reaped $2.75 billion in … as part of the Solyndra investigation show that venture capitalists who held …

E-mails Link Solyndra Investors, Campaign Donors and White House …

humanevents.com/…/emails-link-solyndra-investors-campaign-donors-…

Human Events

Oct 11, 2011 – Before we get to the latest Solyndra scandal involving the most honest, … What we do know is that Solyndra paid the law firm, Wilson Sonsini, …

House panel seeks more Solyndra documents – Washington Times

www.washingtontimes.com/…/house-panel-seeks-more-solynd…

The Washington Times

Jan 16, 2012 – The committee also sent letters seeking documents from another law firm, Wilson Sonsini Goodrich & Rosati, which advised Solyndra in the …

WSGR AND THE JUNIPER NETWORKS CORRUPTION

Wilson Sonsini appears to have known that Juniper Networks had built spy back-doors into it’s networking products and that every Russian, Chinese and teenage hacker had the keys to those back-doors.

Did WSGR advise it’s client: Juniper Networks to just “keep quiet” about the risk and expose it’s customers to billions of dollars of hacks and leaks that then occurred?

Did Juniper avoid telling it’s clients of the known risk because Juniper didn’t want to foot the bill for replacing all of the hardware in it’s customer’s networks?

Secret Code Found in Juniper’s Firewalls Shows Risk of …

Suspicious code found in Juniper’s firewall software underscores why governments shouldn’t be allowed to install their own backdoors in software.

bing google yahoo cached

https://www.wired.com/2015/12/juniper-[…]show-the-risk-of-government-backdoors/

Juniper Networks – Wikipedia, the free encyclopedia

Juniper Networks is a multinational corporation headquartered in Sunnyvale, California that develops and markets networking products. Its products include routers …

bing yahoo cached

https://en.wikipedia.org/wiki/Juniper_Networks

Researchers Solve Juniper Backdoor Mystery; Signs … – WIRED

Security researchers believe they have finally solved the mystery around how a sophisticated backdoor embedded in Juniper firewalls works.

bing google yahoo cached

https://www.wired.com/2015/12/research[…]they-say-its-partially-the-nsas-fault/

Juniper firewall backdoors add fuel to encryption …

Juniper firewall backdoors exposed systems to remote access authentication and VPN backdoors, and many are blaming the NSA.

bing yahoo cached

http://searchsecurity.techtarget.com/n[…]ackdoors-add-fuel-to-encryption-debate

Juniper Networks – 2015-12 Out of Cycle Security …

The Juniper SIRT strongly recommends upgrading to a fixed release (in Solution section above) to resolve these critical vulnerabilities. CVE-2015-7755 (unauthorized …

bing yahoo cached

http://kb.juniper.net/InfoCenter/index?page=content&id=JSA10713

What REALLY Happened with the Juniper Networks …

What REALLY Happened with the Juniper Networks Hack? Last month, it was revealed that Juniper Networks’ routers/firewalls were hacked. It was reported that a backdoor …

bing yahoo cached

http://null-byte.wonderhowto.com/news/[…]ed-with-juniper-networks-hack-0167439/

Juniper’s VPN security hole is proof that govt backdoors …

Is Pure Storage a solid business or is skepticism justified? Juniper’s security nightmare gets worse and worse as experts comb the ScreenOS firmware in its old …

bing yahoo cached

http://www.theregister.co.uk/2015/12/23/juniper_analysis/

Juniper Finds Backdoor In NetScreen Firewalls, Possibly …

Juniper Networks uncovered vulnerabilities that would give attackers complete control over its NetScreen firewalls and would allow them to decrypt VPN traffic undetected.

bing yahoo cached

http://www.tomshardware.com/news/junip[…]rks-finds-screenos-backdoor,30786.html

New Discovery Around Juniper Backdoor Raises More Questions …

Jan 8, 2016 … When tech giant Juniper Networks made the startling announcement last month that it had uncovered two mysterious backdoors embedded in …

google cached

https://www.wired.com/2016/01/new-disc[…]ises-more-questions-about-the-company/

“Unauthorized code” in Juniper firewalls decrypts …

Dec 17, 2015 · An operating system used to manage firewalls sold by Juniper Networks contains unauthorized code that surreptitiously decrypts traffic sent through …

bing yahoo cached

http://arstechnica.com/security/2015/1[…]ewalls-decrypts-encrypted-vpn-traffic/

important Juniper security announcement – Juniper Networks

IMPORTANT JUNIPER SECURITY ANNOUNCEMENT CUSTOMER UPDATE: DECEMBER 20, 2015 Administrative Access (CVE-2015-7755) only affects ScreenOS …

bing yahoo cached

http://forums.juniper.net/t5/Security-[…]nnouncement-about-ScreenOS/ba-p/285554

Details about Juniper’s Firewall Backdoor – Schneier on Security

Apr 19, 2016 … Last year, we learned about a backdoor in Juniper firewalls, one that seems … Abstract: In December 2015, Juniper Networks announced that …

google cached

https://www.schneier.com/blog/archives/2016/04/details_about_j.html

Juniper drops NSA-developed code following new backdoor …

Jan 10, 2016 … Juniper Networks, which last month made the startling announcement its NetScreen line of firewalls contained unauthorized code that can …

google cached

http://arstechnica.com/security/2016/0[…]de-following-new-backdoor-revelations/

NSA faces US probe over Juniper backdoor code claims | V3

The US government has launched an investigation following the discovery of ” unauthorised code” in firewall software from Juniper Networks to determine …

google cached

http://www.v3.co.uk/v3-uk/news/2439783[…]rypting-vpn-traffic-in-its-firewall-os

Juniper Networks to rip out NSA-developed code amid new …

Jan 11, 2016 … Juniper Networks recently announced it will be dropping the … Networks to rip out NSA-developed code amid new backdoor security concerns.

google cached

http://www.techrepublic.com/article/ju[…]e-amid-new-backdoor-security-concerns/

Hack at Juniper Networks raises more questions about software …

Dec 29, 2015 … Juniper’s announcement raises questions about whether encrypted networks should include so-called backdoors at all, which law enforcement …

google cached

http://www.marketwatch.com/story/junip[…]e-questions-about-backdoors-2015-12-28

A large number of the clients that WSGR seems to be partnered with, connected to, or financed by the Cartel known as The Silicon Valley Cartel. This Cartel is made up of a set of Silicon Valley men who call themselves “Venture Capitalists”. They work together as a group and have recently been publicly indicted in the AngelGate Scandal, The No Poaching Class Action Lawsuit Scandal, The Cleantech Crash Scandal and a number of bizarre sexual escapade scandals.

WSGR also offers classes and training, for it’s clients, on how to get away with corruption. Yes, this writer has copies of emails and flyers in which WSGR offers its clients training in getting away with bribes, overseas money laundering and tax evasion. What a helpful group they are.

Will the FBI, FTC or legal professional licensing agencies step in. We sure hope so.